DOW30 monthly#

Example of long-only portfolio among DOW-30 components.

Monthly rebalance, backtest spans from the start of data of the components of the current index (in the 60s), the other stocks enter the backtest as times goes on. It ends today.

This uses an explicit loop to create

cvxportfolio.MultiPeriodOptimization

policies with a grid of values for the risk term multiplier

and the transaction cost term multiplier. (We don’t use the

holding cost term because the portfolio is long-only.)

All result objects are collected, and then the one with largest Sharpe ratio, and the one with largest growth rate, are shown.

Finally, we show the effect of using symbolic hyper-parameters,

cvxportfolio.Gamma, as multipliers of the risk and transaction

cost terms. We can optimize on those explicitely, by finding the values

that maximize some back-test metric (in this case, profit).

Running the full example involves solving many (~100) back-tests, it takes a few minutes to half an hour or longer depending on how fast your computer is and how many processors it has. (Each back-test occupies one processor.)

import matplotlib.pyplot as plt

import numpy as np

import cvxportfolio as cvx

# we have up-to-date components of a few market indexes in the

# universes.py example script

from .universes import DOW30

# we use monthly resampling to make the example run faster

sim = cvx.StockMarketSimulator(DOW30, trading_frequency='monthly')

def make_policy(gamma_trade, gamma_risk):

"""Build MPO policy given risk and trans. cost multipliers.

:param gamma_trade: Transaction cost multiplier.

:type gamma_trade: float or int

:param gamma_risk: Risk model multiplier.

:type gamma_risk: float or int

:return: Multi-period optimization policy with given

hyper-parameter values.

:rtype: cvxportfolio.Policy

"""

return cvx.MultiPeriodOptimization(cvx.ReturnsForecast()

- gamma_risk * cvx.FactorModelCovariance(num_factors=10)

- gamma_trade * cvx.StocksTransactionCost(),

[cvx.LongOnly(), cvx.LeverageLimit(1)],

planning_horizon=6, solver='ECOS')

# define combinations of hyper-parameters

keys = [(gamma_trade, gamma_risk)

for gamma_trade in np.array(range(10))/10

for gamma_risk in [.5, 1, 2, 5, 10]]

# define many policies and back-test them in parallel

ress = sim.backtest_many([make_policy(*key) for key in keys])

# pick the result with the largest Sharpe ratio

print('\n\nLARGEST SHARPE RATIO')

idx = np.argmax([el.sharpe_ratio for el in ress])

print('gamma_trade and gamma_risk')

print(keys[idx])

print('result')

print(ress[idx])

largest_sharpe_figure = ress[idx].plot()

# pick the result with the largest growth rate (i.e., largest profit)

print('\n\nLARGEST GROWTH RATE')

idx = np.argmax([el.growth_rates.mean() for el in ress])

print('gamma_trade and gamma_risk')

print(keys[idx])

print('result')

print(ress[idx])

largest_growth_figure = ress[idx].plot()

# also try uniform allocation, for comparison

print('\n\nUNIFORM (1/N) ALLOCATION FOR COMPARISON')

result_uniform = sim.backtest(cvx.Uniform())

print('result_uniform')

print(result_uniform)

figure_uniform = result_uniform.plot()

# finally, run automatic hyper-parameter optimization

print('\n\nHYPER-PARAMETER OPTIMIZATION')

policy = cvx.MultiPeriodOptimization(cvx.ReturnsForecast()

- cvx.Gamma() * cvx.FactorModelCovariance(num_factors=10)

- cvx.Gamma() * cvx.StocksTransactionCost(),

[cvx.LongOnly(), cvx.LeverageLimit(1)],

planning_horizon=6, solver='ECOS')

sim.optimize_hyperparameters(policy, objective='profit')

result_hyperparameter_optimized = sim.backtest(policy)

print('result_hyperparameter_optimized')

print(result_hyperparameter_optimized)

hyp_optimized_figure = result_hyperparameter_optimized.plot()

This is the output printed to screen when executing this script. You can see many statistics of the back-tests.

Updating data..............................

LARGEST SHARPE RATIO

gamma_trade and gamma_risk

(0.9, 5)

result

###########################################################

Universe size 31

Initial timestamp 1963-02-01 14:30:00

Final timestamp 2024-03-01 14:30:00

Number of periods 734

Initial value (USDOLLAR) 1.000e+06

Final value (USDOLLAR) 1.972e+09

Profit (USDOLLAR) 1.971e+09

Avg. return (annualized) 13.1%

Volatility (annualized) 11.5%

Avg. excess return (annualized) 8.4%

Avg. active return (annualized) 8.4%

Excess volatility (annualized) 11.5%

Active volatility (annualized) 11.5%

Avg. growth rate (annualized) 12.4%

Avg. excess growth rate (annualized) 7.7%

Avg. active growth rate (annualized) 7.7%

Avg. StocksTransactionCost 2bp

Max. StocksTransactionCost 153bp

Avg. StocksHoldingCost 0bp

Max. StocksHoldingCost 0bp

Sharpe ratio 0.73

Information ratio 0.73

Avg. drawdown -4.6%

Min. drawdown -39.5%

Avg. leverage 55.8%

Max. leverage 100.1%

Avg. turnover 1.5%

Max. turnover 34.2%

Avg. policy time 0.040s

Avg. simulator time 0.008s

Of which: market data 0.001s

Total time 35.338s

###########################################################

LARGEST GROWTH RATE

gamma_trade and gamma_risk

(0.3, 1)

result

###########################################################

Universe size 31

Initial timestamp 1963-02-01 14:30:00

Final timestamp 2024-03-01 14:30:00

Number of periods 734

Initial value (USDOLLAR) 1.000e+06

Final value (USDOLLAR) 1.360e+11

Profit (USDOLLAR) 1.360e+11

Avg. return (annualized) 24.5%

Volatility (annualized) 31.5%

Avg. excess return (annualized) 19.7%

Avg. active return (annualized) 19.7%

Excess volatility (annualized) 31.6%

Active volatility (annualized) 31.6%

Avg. growth rate (annualized) 19.4%

Avg. excess growth rate (annualized) 14.6%

Avg. active growth rate (annualized) 14.6%

Avg. StocksTransactionCost 12bp

Max. StocksTransactionCost 1198bp

Avg. StocksHoldingCost 0bp

Max. StocksHoldingCost 0bp

Sharpe ratio 0.63

Information ratio 0.63

Avg. drawdown -25.7%

Min. drawdown -81.3%

Avg. leverage 97.7%

Max. leverage 112.2%

Avg. turnover 2.7%

Max. turnover 85.8%

Avg. policy time 0.048s

Avg. simulator time 0.009s

Of which: market data 0.001s

Total time 41.593s

###########################################################

UNIFORM (1/N) ALLOCATION FOR COMPARISON

result_uniform

###########################################################

Universe size 31

Initial timestamp 1963-02-01 14:30:00

Final timestamp 2024-03-01 14:30:00

Number of periods 734

Initial value (USDOLLAR) 1.000e+06

Final value (USDOLLAR) 8.997e+09

Profit (USDOLLAR) 8.996e+09

Avg. return (annualized) 16.4%

Volatility (annualized) 16.9%

Avg. excess return (annualized) 11.7%

Excess volatility (annualized) 17.0%

Avg. growth rate (annualized) 14.9%

Avg. excess growth rate (annualized) 10.2%

Avg. StocksTransactionCost 6bp

Max. StocksTransactionCost 360bp

Avg. StocksHoldingCost 0bp

Max. StocksHoldingCost 0bp

Sharpe ratio 0.69

Avg. drawdown -5.5%

Min. drawdown -51.9%

Avg. leverage 99.9%

Max. leverage 103.6%

Avg. turnover 2.6%

Max. turnover 50.0%

Avg. policy time 0.000s

Avg. simulator time 0.005s

Of which: market data 0.001s

Total time 3.395s

###########################################################

HYPER-PARAMETER OPTIMIZATION

iteration 0

Current objective:

98290861668.7877

iteration 1

Current objective:

104498474911.47737

iteration 2

Current objective:

111143662042.72948

iteration 3

Current objective:

118265870300.22061

iteration 4

Current objective:

122625251613.47884

iteration 5

Current objective:

126843647987.58827

iteration 6

Current objective:

130775820171.06282

iteration 7

Current objective:

134763415937.55232

iteration 8

Current objective:

138648657008.04605

iteration 9

Current objective:

142616756158.97928

iteration 10

Current objective:

146451509882.4869

iteration 11

Current objective:

150426864277.33624

iteration 12

Current objective:

154489826957.43265

iteration 13

Current objective:

158227019575.06552

iteration 14

Current objective:

161400378727.53326

iteration 15

Current objective:

163922145513.48956

iteration 16

Current objective:

165526213503.99875

iteration 17

Current objective:

165577391667.23886

result_hyperparameter_optimized

###########################################################

Universe size 31

Initial timestamp 1963-02-01 14:30:00

Final timestamp 2024-03-01 14:30:00

Number of periods 734

Initial value (USDOLLAR) 1.000e+06

Final value (USDOLLAR) 1.656e+11

Profit (USDOLLAR) 1.656e+11

Avg. return (annualized) 25.8%

Volatility (annualized) 34.7%

Avg. excess return (annualized) 21.1%

Avg. active return (annualized) 21.1%

Excess volatility (annualized) 34.7%

Active volatility (annualized) 34.7%

Avg. growth rate (annualized) 19.7%

Avg. excess growth rate (annualized) 15.0%

Avg. active growth rate (annualized) 15.0%

Avg. StocksTransactionCost 14bp

Max. StocksTransactionCost 1491bp

Avg. StocksHoldingCost 0bp

Max. StocksHoldingCost 0bp

Sharpe ratio 0.61

Information ratio 0.61

Avg. drawdown -27.6%

Min. drawdown -85.4%

Avg. leverage 98.6%

Max. leverage 115.5%

Avg. turnover 2.7%

Max. turnover 87.4%

Avg. policy time 0.039s

Avg. simulator time 0.006s

Of which: market data 0.001s

Total time 32.714s

###########################################################

And these are the figure that are plotted.

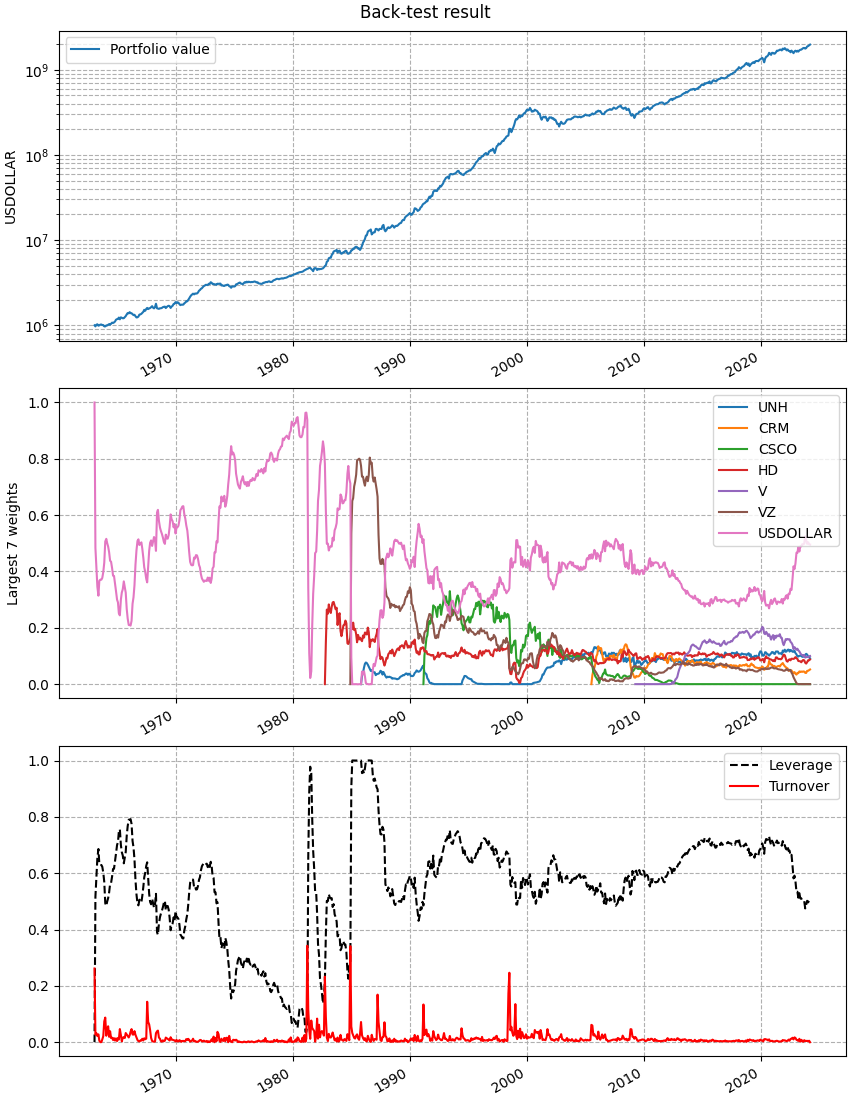

The result of the cvxportfolio.MultiPeriodOptimization policy

that has the largest out-of-sample Sharpe ratio:

This figure is made by the cvxportfolio.result.BacktestResult.plot() method.#

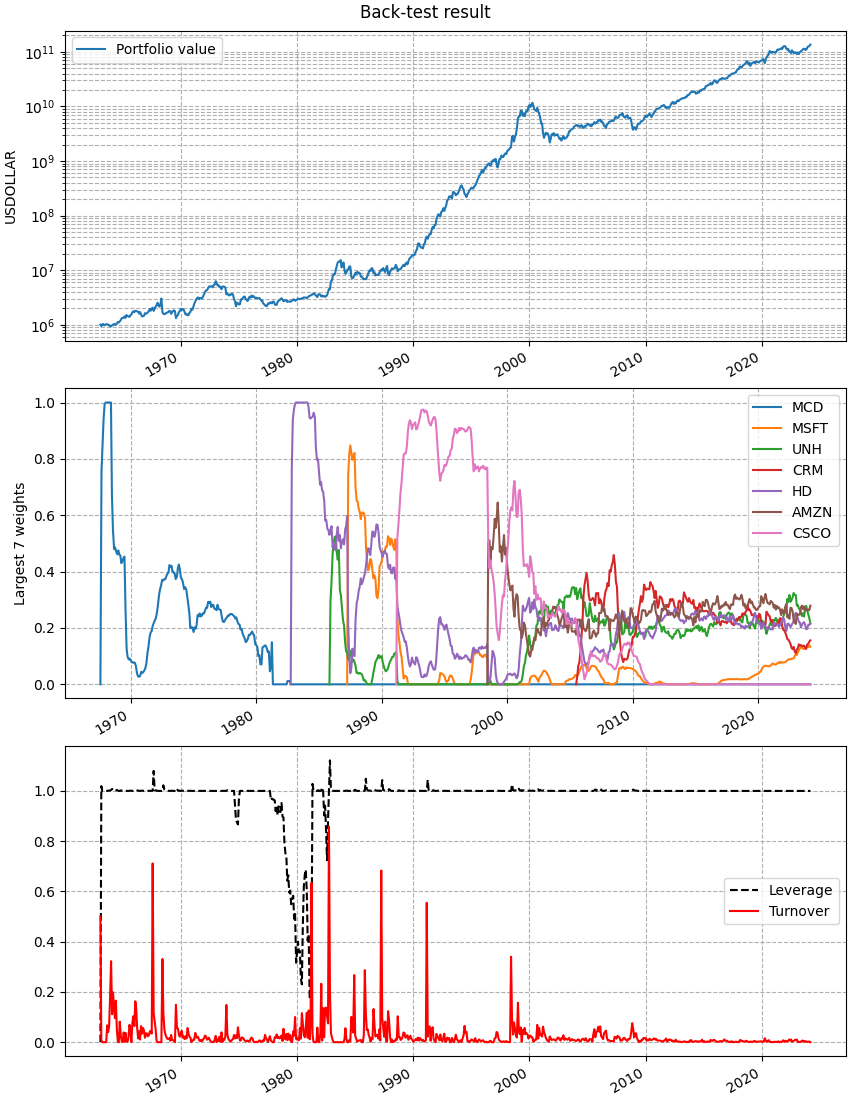

The result of the cvxportfolio.MultiPeriodOptimization policy

that has the largest out-of-sample growth rate:

This figure is made by the cvxportfolio.result.BacktestResult.plot() method.#

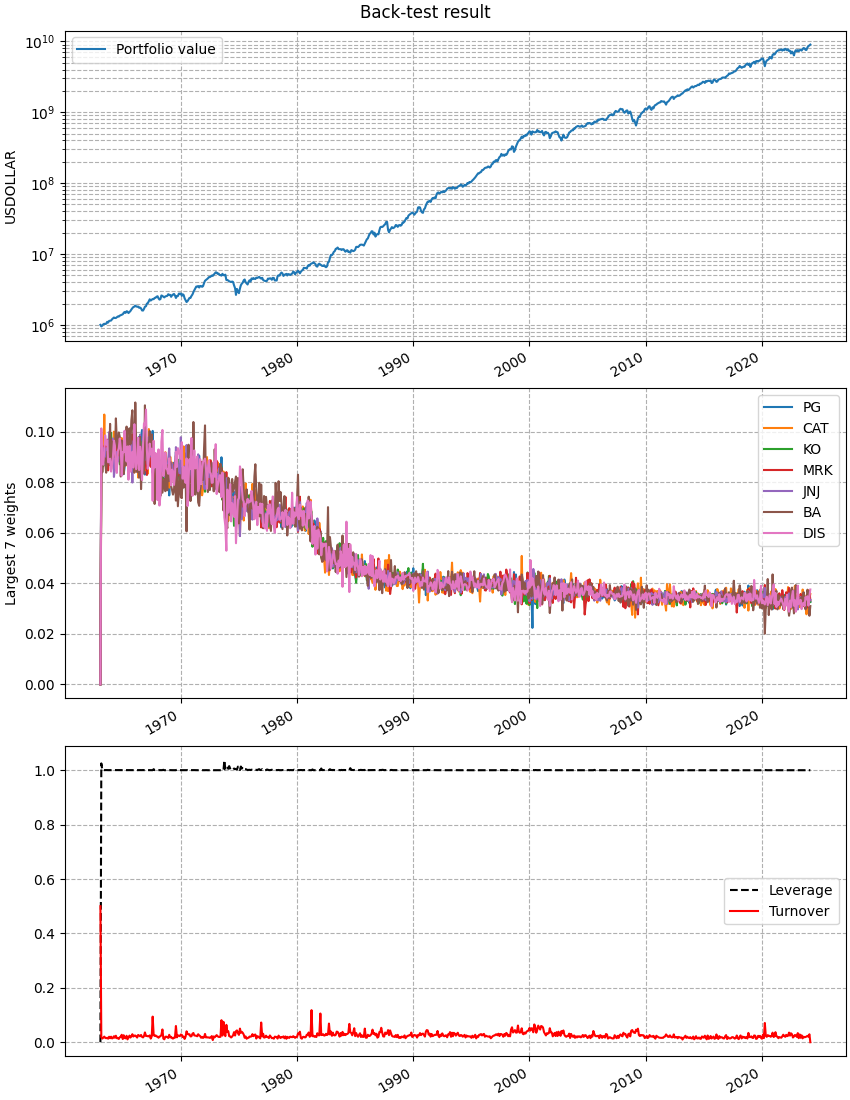

The result of the cvxportfolio.Uniform policy, which allocates equal

weight to all non-cash assets:

This figure is made by the cvxportfolio.result.BacktestResult.plot() method.#

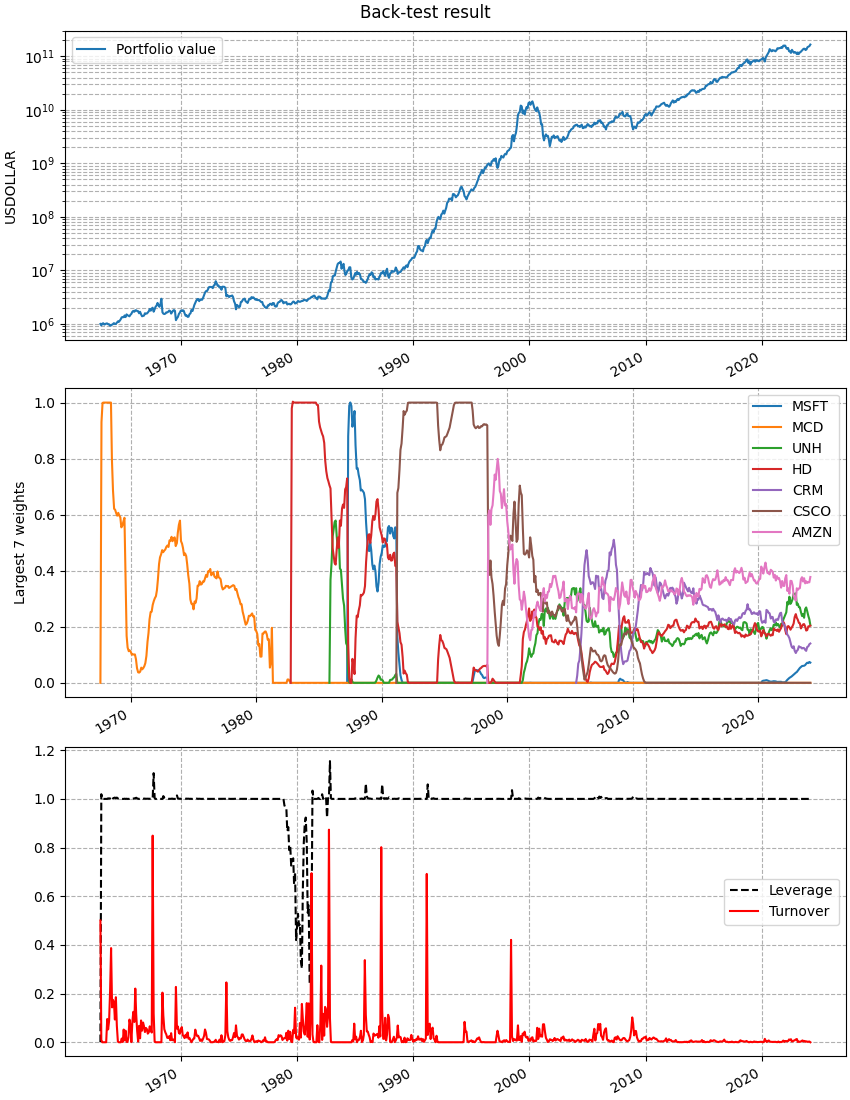

Finally, the result of the cvxportfolio.MultiPeriodOptimization policy

obtained by automatic hyper-parameter optimization to have largest profit:

This figure is made by the cvxportfolio.result.BacktestResult.plot() method.#