Wide asset classes ETFs#

ETFs example covering the main asset classes.

This uses an explicit loop to create Multi Period Optimization policies with a grid of values for the risk term multiplier and the transaction cost term multiplier.

All result objects are collected, and then the one with largest Sharpe ratio, and the one with largest growth rate, are shown.

import numpy as np

import cvxportfolio as cvx

UNIVERSE = [

"QQQ", # nasdaq 100

"SPY", # US large caps

'EFA', # EAFE stocks

"CWB", # convertible bonds

"IWM", # US small caps

"EEM", # EM stocks

"GLD", # Gold

'TLT', # long duration treasuries

'HYG', # high yield bonds

"EMB", # EM bonds (usd)

'LQD', # investment grade bonds

'PFF', # preferred stocks

'VNQ', # US REITs

'BND', # US total bond market

'BIL', # US cash

'TIP', # TIPS

'DBC', # commodities

]

sim = cvx.StockMarketSimulator(UNIVERSE, trading_frequency='monthly')

def make_policy(gamma_trade, gamma_risk):

"""Create policy object given hyper-parameter values.

:param gamma_trade: Choice of the trading aversion multiplier.

:type gamma_trade: float

:param gamma_risk: Choice of the risk aversion multiplier.

:type gamma_risk: float

:returns: Policy object with given choices of hyper-parameters.

:rtype: cvx.policies.Policy instance

"""

return cvx.MultiPeriodOptimization(cvx.ReturnsForecast()

- gamma_risk * cvx.FactorModelCovariance(num_factors=10)

- gamma_trade * cvx.StocksTransactionCost(),

[cvx.LongOnly(), cvx.LeverageLimit(1)],

planning_horizon=6, solver='ECOS')

keys = [(gamma_trade, gamma_risk)

for gamma_trade in np.array(range(10))/10

for gamma_risk in [.5, 1, 2, 5, 10]]

ress = sim.backtest_many(

[make_policy(*key) for key in keys], parallel=True)

print('LARGEST SHARPE RATIO')

idx = np.argmax([el.sharpe_ratio for el in ress])

print('gamma_trade and gamma_risk')

print(keys[idx])

print('result')

print(ress[idx])

largest_sharpe_figure = ress[idx].plot()

print('LARGEST GROWTH RATE')

idx = np.argmax([el.growth_rates.mean() for el in ress])

print('gamma_trade and gamma_risk')

print(keys[idx])

print('result')

print(ress[idx])

largest_growth_figure = ress[idx].plot()

This is the output printed to screen when executing this script. You can see many statistics of the back-tests.

Updating data.................

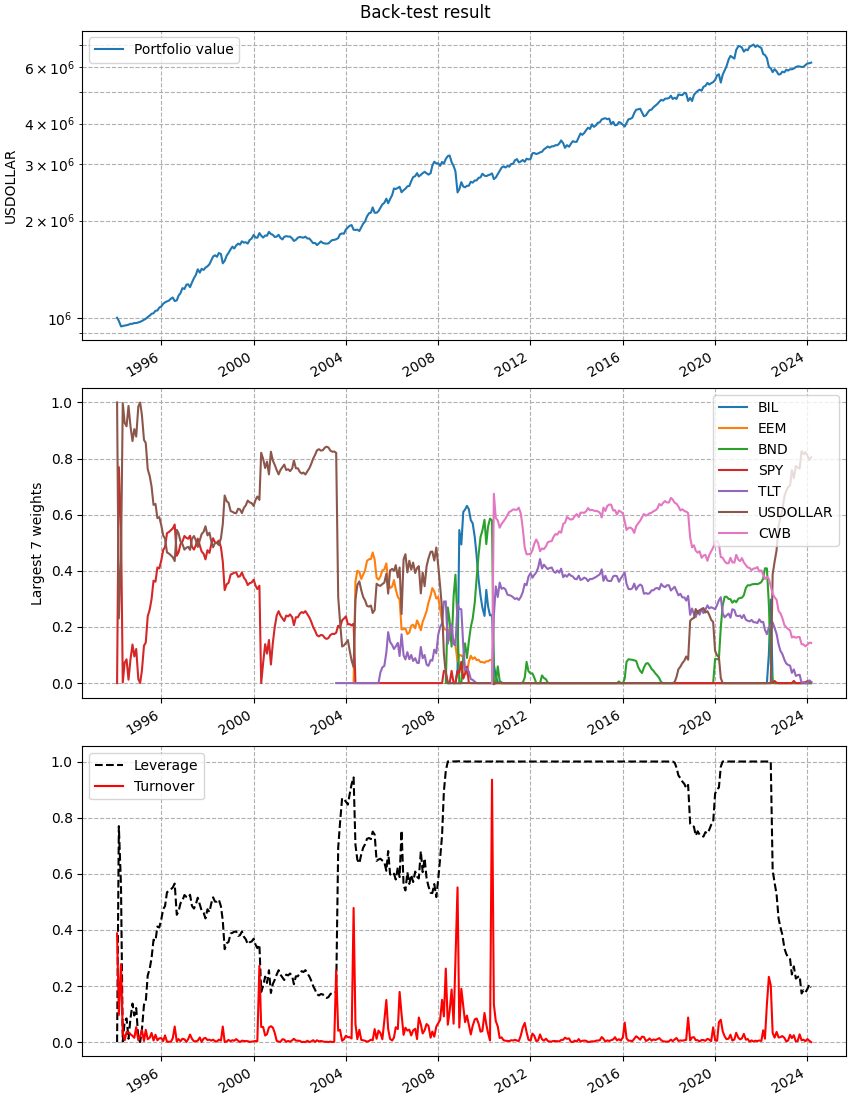

LARGEST SHARPE RATIO

gamma_trade and gamma_risk

(0.9, 10)

result

###########################################################

Universe size 18

Initial timestamp 1994-02-01 14:30:00

Final timestamp 2024-03-01 14:30:00

Number of periods 362

Initial value (USDOLLAR) 1.000e+06

Final value (USDOLLAR) 6.180e+06

Profit (USDOLLAR) 5.180e+06

Avg. return (annualized) 6.3%

Volatility (annualized) 7.2%

Avg. excess return (annualized) 3.9%

Avg. active return (annualized) 3.9%

Excess volatility (annualized) 7.1%

Active volatility (annualized) 7.1%

Avg. growth rate (annualized) 6.1%

Avg. excess growth rate (annualized) 3.6%

Avg. active growth rate (annualized) 3.6%

Avg. StocksTransactionCost 0bp

Max. StocksTransactionCost 40bp

Avg. StocksHoldingCost 0bp

Max. StocksHoldingCost 0bp

Sharpe ratio 0.55

Information ratio 0.55

Avg. drawdown -3.7%

Min. drawdown -23.2%

Avg. leverage 68.1%

Max. leverage 100.4%

Avg. turnover 3.3%

Max. turnover 93.5%

Avg. policy time 0.025s

Avg. simulator time 0.007s

Of which: market data 0.001s

Total time 11.750s

###########################################################

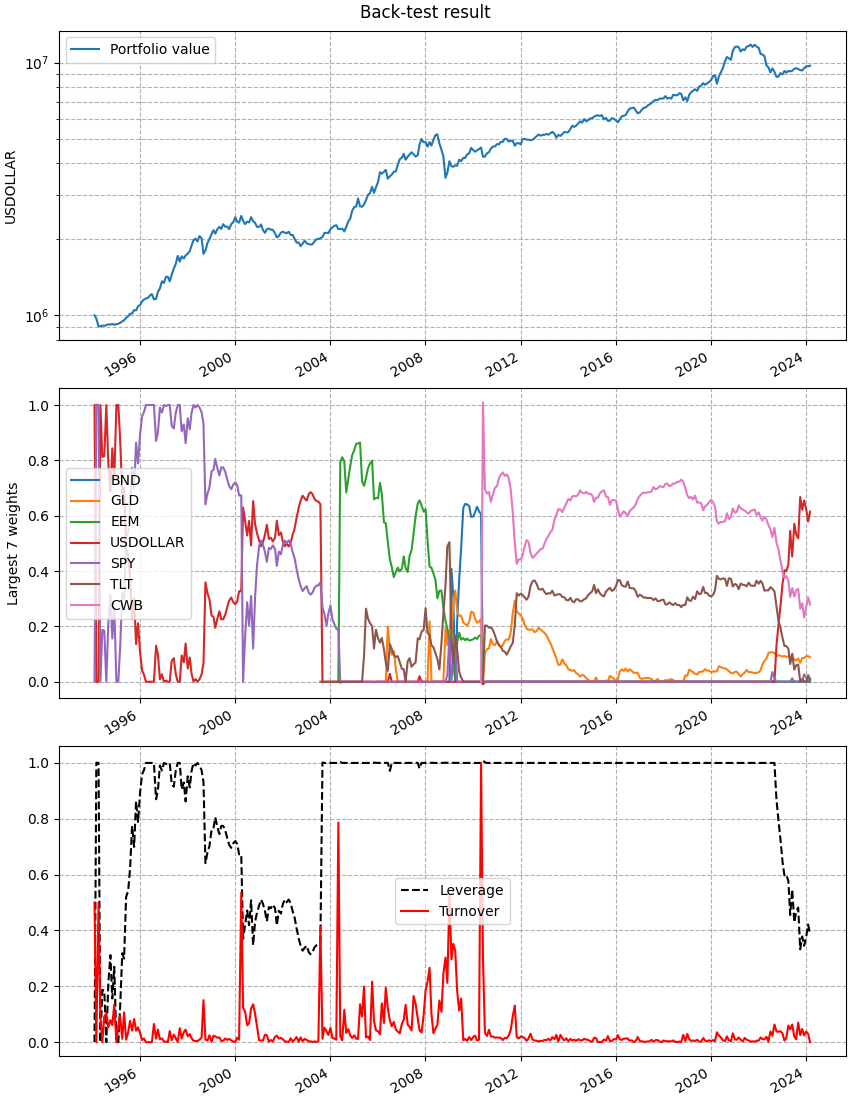

LARGEST GROWTH RATE

gamma_trade and gamma_risk

(0.0, 5)

result

###########################################################

Universe size 18

Initial timestamp 1994-02-01 14:30:00

Final timestamp 2024-03-01 14:30:00

Number of periods 362

Initial value (USDOLLAR) 1.000e+06

Final value (USDOLLAR) 9.716e+06

Profit (USDOLLAR) 8.716e+06

Avg. return (annualized) 8.2%

Volatility (annualized) 11.3%

Avg. excess return (annualized) 5.8%

Avg. active return (annualized) 5.8%

Excess volatility (annualized) 11.3%

Active volatility (annualized) 11.3%

Avg. growth rate (annualized) 7.6%

Avg. excess growth rate (annualized) 5.1%

Avg. active growth rate (annualized) 5.1%

Avg. StocksTransactionCost 1bp

Max. StocksTransactionCost 84bp

Avg. StocksHoldingCost 0bp

Max. StocksHoldingCost 0bp

Sharpe ratio 0.51

Information ratio 0.51

Avg. drawdown -6.4%

Min. drawdown -32.7%

Avg. leverage 85.6%

Max. leverage 100.9%

Avg. turnover 4.6%

Max. turnover 100.0%

Avg. policy time 0.024s

Avg. simulator time 0.007s

Of which: market data 0.001s

Total time 11.316s

###########################################################

And these are the figure that are plotted.

The result of the cvxportfolio.MultiPeriodOptimization policy

that has the largest out-of-sample Sharpe ratio:

This figure is made by the cvxportfolio.result.BacktestResult.plot() method.#

The result of the cvxportfolio.MultiPeriodOptimization policy

that has the largest out-of-sample growth rate:

This figure is made by the cvxportfolio.result.BacktestResult.plot() method.#